With a series of jumps across key regions of the country, the national average price of diesel fuel in the U.S. has slightly elevated, up 1.3 cents per gallon from a week ago. The subtle creep upward breaks a ten-week streak of price decreases.

The national average now stands at $3.54 per gallon.

U.S. diesel prices down since last year

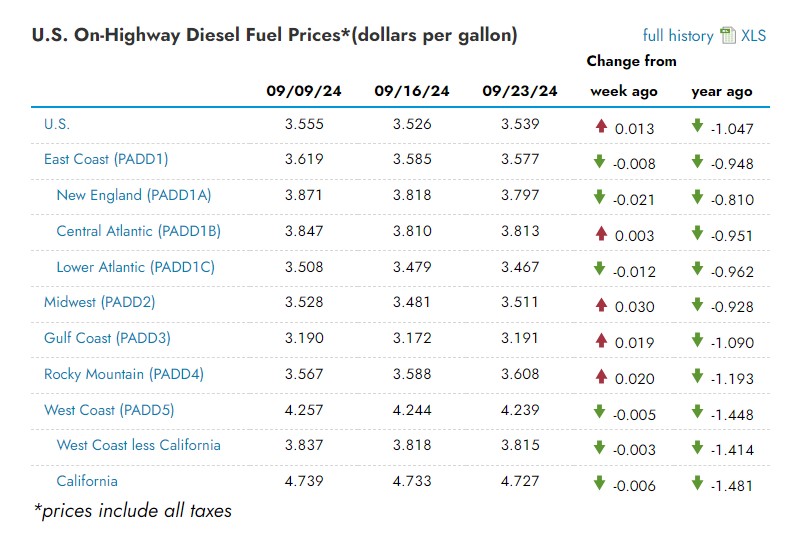

Courtesy of data provided by the U.S. EIA, a government agency which tracks fuel prices across the nation and several defined regions, diesel prices have towed the line in the U.S. While, altogether, the national average rose, the overall result is formed by a collective of increases and decreases reported across the contiguous U.S.

As presented below, the following regions (and subregions) tracked increases in their respective diesel price per gallon averages between the week of Sep. 16 and Sep. 23: Central Atlantic rose 0.3 cents; Midwest rose 3 cents; Gulf Coast rose nearly 2 cents; and Rocky Mountain rose 2 cents. The remaining regions enjoyed marginal decreases within the same period.

The State of Diesel: Main Takeaways

- Despite the minor gain, diesel is considerably cheaper than it was a year ago. The national average is down $1.05 compared to the same period in 2023.

- While there were a handful of decreases and increases mixed about across regions, the results are comparably balanced compared to 2023, a period of volatility for diesel prices.

- The Midwest region saw the highest week-over-week increase as diesel jumped 3 cents since Sep. 16 and currently sits at $3.51 per gallon. The Midwest includes the largest number of states in the EIA’s regional index with 15.

- While perennially holding the honor of possessing the highest prices at the pump, the West Coast region observed the largest year-over-year decline. The regional diesel average dropped $1.45 per gallon from the same period in 2023. As suspected, the region still remains the most expensive. It’s currently the only one where diesel is above $4 per gallon.

- California, which the EIA awards a separate subregion, is remarkably above the national average at $4.73 per gallon. In addition to its large area and population, California is home to the nation’s busiest container ports, sowing a bustling demand for drayage trucking. California is notorious for high operating costs.

- The Gulf Coast region saw prices climb 1.9 cents to $3.19 per gallon. Of all regions, the Gulf Coast currently possesses the lowest diesel average in the U.S. by a noticeable margin. This isn’t out of the ordinary either. The region’s proximity to major refineries can be thanked for the Gulf Coast’s familiar distinction of being the nation’s cheapest region for fuel.

Fuel is a contributor to freight rates

At first glance, it may seem like only truck drivers would keep an eye on diesel prices. However, even supply chain professionals who commute on e-bikes should check the pulse of fuel market to better understand the role it plays in transportation costs.

Both literally and figuratively, diesel is what fuels the trucking industry. While there could be a day when alternatives take over, diesel is virtually the single fuel source powering fleets across the country. Trucking companies, who are dependent on fuel supply just like shippers are dependent on truckload capacity, are keen to adapt whenever the price of diesel fluctuates. In other words, if diesel trends upward, freight rates will promptly follow suit as result of trucking companies making up for the increase in operating costs. Afterall, if they didn’t, they would be compromising their financial health.

So, whether it’s an asset-based trucking company or a third-party freight broker, fuel costs are passed on to shipper-customers.

Service perspective: Regular carrier-shipper partnerships create pricing transparency

The idea of fluctuating fuel costs impacting freight rates can be unsettling given the volatility that the diesel market has expressed most recently in 2023.

For companies who have partnered with the same transportation providers on their regular freight lanes, a greater sense of visibility can be offered in the event of higher trucking costs associated with changing diesel prices. Unlike the spot market, recurring business between carrier and shipper allows for changes in freight rates to be communicated between the two partners. In the event of fluctuating diesel prices, carriers should reflect changes to price through fuel surcharges, an additional fee which explains why the shipper is paying more for the same service.

Commerce Express Inc. provides the following assurances to clients when addressing and implementing fuel surcharges:

- Walk through with clients how Commerce Express Inc. calculates fuel surcharges

- Itemize fuel surcharges separately on invoices, allowing clients to understand the direct impact fuel costs had on the total service cost

Recent Comments